By Bob Hemmick, Sales Vice President

Reminder that for the high earner, the current Federal Income tax rate is 39.5%. Add State and Local taxes and we have a marginal tax rate approaching 50%.

2014 Tax Brackets (for taxes due April 15, 2015)

| Tax rate | Single filers | Married filing jointly or qualifying widow/widower | Married filing separately | Head of household |

| 10% | Up to $9,075 | Up to $18,150 | Up to $9,075 | Up to $12,950 |

| 15% | $9,076 to $36,900 | $18,151 to $73,800 | $9,076 to $36,900 | $12,951 to $49,400 |

| 25% | $36,901 to $89,350 | $73,801 to $148,850 | $36,901 to $74,425 | $49,401 to $127,550 |

| 28% | $89,351 to $186,350 | $148,851 to $226,850 | $74,426 to $113,425 | $127,551 to $206,600 |

| 33% | $186,351 to $405,100 | $226,851 to $405,100 | $113,426 to $202,550 | $206,601 to $405,100 |

| 35% | $405,101 to $406,750 | $405,101 to $457,600 | $202,551 to $228,800 | $405,101 to $432,200 |

| 39.6% | $406,751 or more | $457,601 or more | $228,801 or more | $432,201 or more |

January is when many think of ways to reduce their income taxes; that is, until they realize that it is too late to alter what transpired during the prior calendar, tax year.

Effective tax planning requires some forethought.

Four Strategies to Reduce Income Taxes

- DIVERT income to a lower tax bracket, like to an UGTMA account or perhaps a “C” corporation or a trust

- CONVERT income (asset) being taxed at ordinary rates, to assets that produce tax free income or are taxed (primarily) at capital gains rates.

- DEFER income currently taxed at high rates to a later time.

- Create additional DEDUCTION.

Effective “Executive Compensation Planning” strives to maximize the use of these four strategies that are the most applicable to the specific details of the client’s situation.

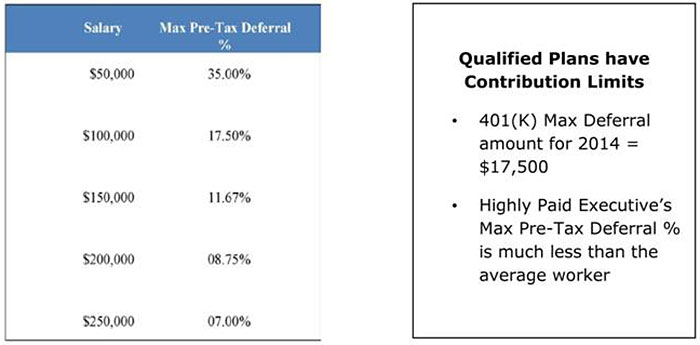

Maximizing the use of a Qualified Plan is a common consideration. A 401(K) is in many instances the first choice for accumulating assets for retirement. A 401(k) plan has limitations for the high earner:

Qualified Plan Reverse Discrimination

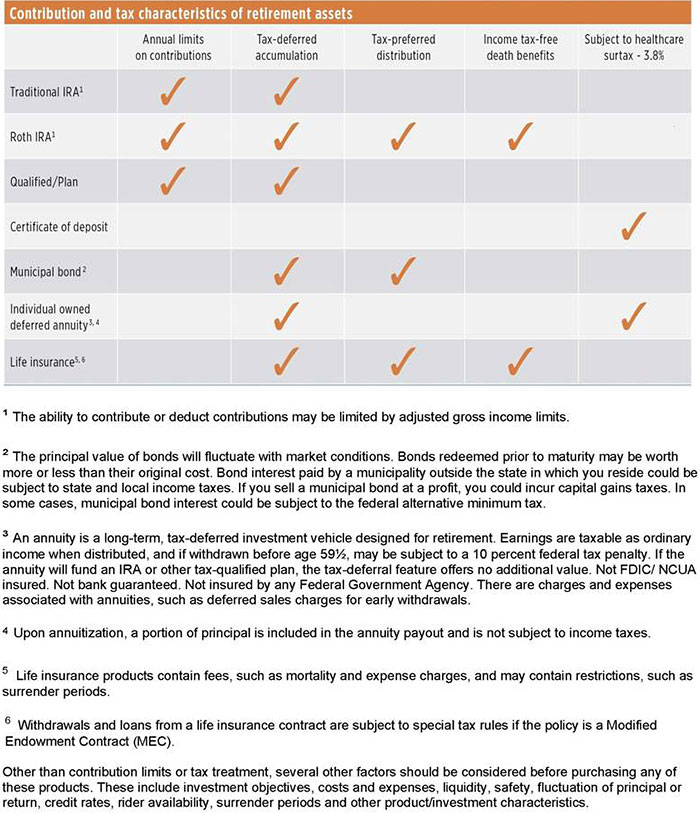

Common Choices for “Tax Advantaged” Retirement Accumulation Strategies

For many, a properly designed Life Insurance plan which can produce a tax free income stream, may be a very compelling alternative.

- For example, in a 40% tax bracket, a tax free income of $50,000 is equivalent to a taxable income of $83,333.