By Bob Hemmick, Sales Vice President

Understanding how the different kinds of permanent insurance plans perform can be a challenge to explain to clients.

Plans being considered: W’L’ – Fixed UL – Variable UL & Index UL.

It’s all in the numbers … and that is the challenge because most people are not members of the math club and do not fully understand how different permanent insurance product designs truly work with the different risk aspects inherent with each design.

Here we have to incorporate principals of investment planning as it applies to the cash reserve portion of the insurance plan.

With any investment alternative there is always a “Dominant Benefit:”

| Dominant Benefit | Vehicle | Risk |

|---|---|---|

| Safety | CD’s – Money Market | Loss of Purchasing Power |

| Income | Corp.- Gov. Bonds | Interest Rate fluctuation – Yield & Principal Value fluctuation |

| Growth | Equity-Stocks – S & P 500 | Strong Fluctuation – Loss of Principal – Volatility |

| Aggressive Growth | Non-div. Stocks – NASDAQ | Strongest Fluctuation of Principal – Most Volatility |

As we understand, when you move from top to bottom in the above example you have a greater potential for more total return and you also have a corresponding greater chance of loss of principal value. Volatility of principal value increases as you move down in these categories.

So now we can assign the product (based on what drives the cash reserves) to the above categories.

| Safety | Guaranteed Portion of WL |

| Income | Divs. Of W’L’ – Credit Rate of UL |

| Growth | Equity sub-accounts in VUL |

| Aggressive Growth | Aggressive Growth Alloc. VUL |

The Index UL would fit between the Income & Growth category above in that it offers participation in the stock market, but with a cap, say 12% and it also has a minimum floor of say, 0% to 2%. For example, if the market has a 30% correction, the IUL has a minimum guarantee return, so the cash reserve portion of the plan never has a negative return.

These assumptions serve as a basis for two points of emphasis:

- W’L’ dividend rates tract the average yield of the Bond Market – the same way the crediting rate in the traditional, fixed UL product.

- The IUL offers an opportunity for more stable returns, with strong potential to outperform the returns reflected in the bond market.

As a generic example, here is an example of the difference a 2% rate of return makes in results over 30 years:

- @ 7%, $5,000 per year invested over 30 years = $472,303

- @ 5%, $5,000 per year invested over 30 years = $332,194

- Difference $140,109

- $140,109 = 30% of $472,303

Comparative Conclusion used as realistic projection (assuming the client does not want to assume the volatility of the stock market with a variable UL):

- 20 – 25 years historical performance record of IUL’s will show an average of 8% +

- Projected Rates on Dividends and Fixed UL = 4% – 5%

Perhaps we can now appreciate why the IUL is a preferred product design for strategies of accumulation where we are “Over-Funding” the premium for a given face amount to develop Tax Free Retirement income.

Balance of Risk and Reward

No single investment offers the maximum potential in all

three categories—always trade offs. What is most important to you?

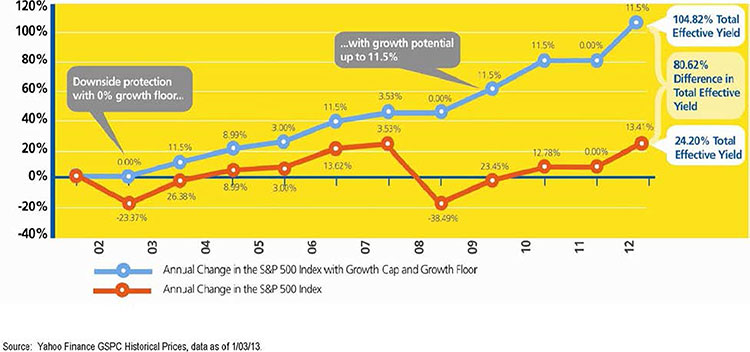

Performance Comparison S & P 500 versus Index UL

Growth and the S&P 500® Index

No single investment offers the maximum potential in all

three categories—always trade offs. What is most important to you?

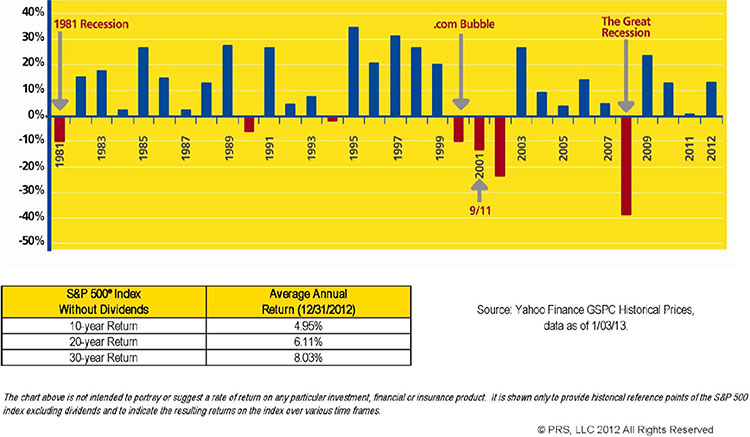

Taking the long View… Far More Ups than Downs

The chart below shows how the S&P 500® Index, excluding dividends, has performed over the last 30 years. You can see that only seven years have had negative growth. Does investing in the S&P 500 Index, excluding dividends, provide consistent, attainable growth rates?

Risk Protection and Effective Yield

Consider what would happen if you could invest in the S&P 500® Index, excluding dividends, and in exchange for a cap on the growth of the index, you also had a growth floor of 0% so that in years where the index goes down you would not realize a loss. Although such a direct investment product does not exist, this conceptual approach has been used as the foundation for the calculation and crediting of interest on a innovative life insurance product known as indexed universal life.