By Bob Hemmick, Sales Vice President

Life insurance is a powerful financial tool that can be used to meet many needs. Most commonly, life insurance is used to provide a death benefit to help secure your family’s financial future when you are gone.

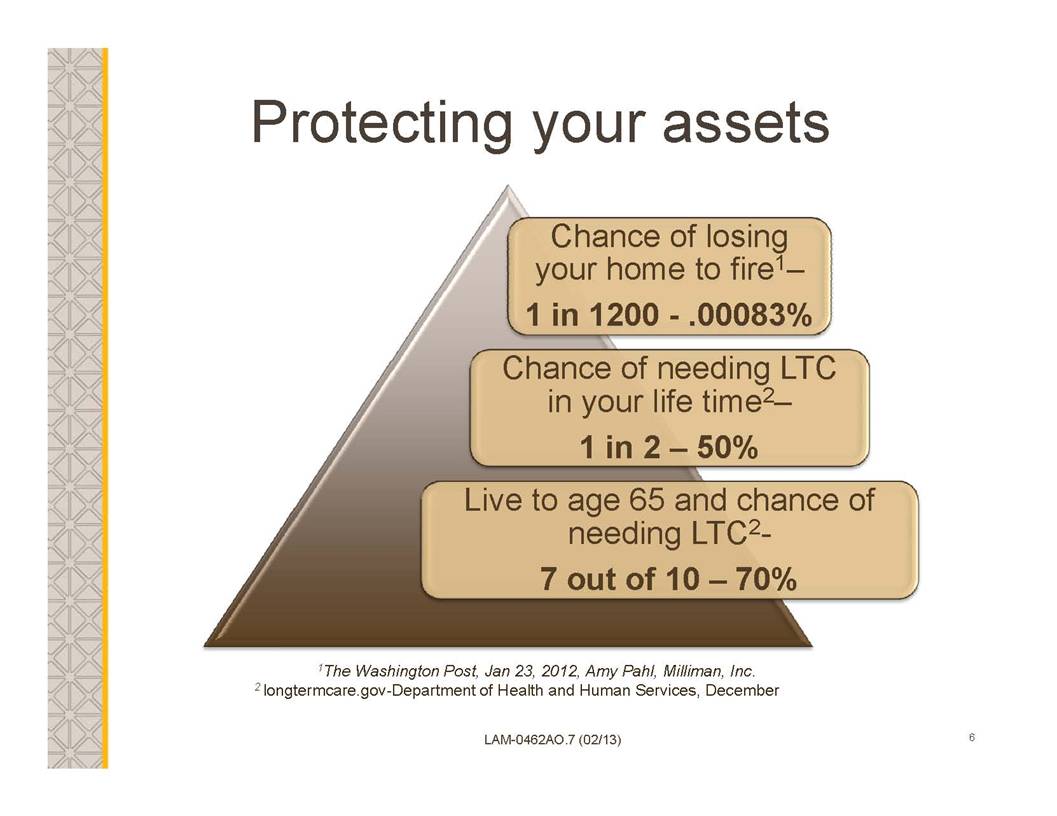

…How do you protect against an unforeseen illness?

Life Insurance can also provide valuable protection with living benefits as well.

The four main differences between Long Term Care and Chronic Illness Agreement generally are the following.

- “Chronic Illness” term involves the client being determined that they will not recover. Long Term Care agreements allow the insured to come off claim and maintain the policy.

- Impact of the death benefit is usually different. LTC is a $1 for $1 spend down of life benefit vs. LTC benefit. Chronic generally is $1 of LTC vs. $2.50 of Life.

- Chronic Illness riders are filled under 101(j) and do not follow HIPAA rules that govern client confidentiality.

- LTC Agreement (MN Life) is filed under 7702. There is a push in congress to get 7702 products favorable tax treatment in the near future (deduction of premiums for example)

Like most things in life, there is no such thing as a free lunch. When benefits are more restrictive the cost is correspondingly less. Some carriers offer chronic illness benefits at no additional cost. One carrier even offers LTC benefits with term insurance.